MISCELLANEOUS BENEFIT INFORMATION

The Consolidated Omnibus Budget Reconciliation Act (Public Law 99-2721, Title X), also known as COBRA, was enacted April 7, 1986. This law requires that, effective July 1, 1987, in addition to offering normal conversion opportunities, the City and the union welfare funds must offer employees and their families the opportunity for an extension of group health and welfare fund coverage (called “continuation of coverage”) at 102% of the group rates in certain situations where a member’s benefits, or his/her eligible dependents’ benefits, under either City basic or the applicable welfare fund, would be reduced or terminated.

Under the law, you have 60 days from the date you receive notice from the NYC Office of Labor Relations to elect continuation coverage for your City basic and/or optional benefits.

NOTE: “Special Continuation of Coverage” — Effective November 13, 2001, New York State law provides that surviving spouses of retired uniformed members of the New York City Police Department can continue their health benefits coverage for life (Cobra for Life). Such coverage will be at a premium of 102% of the group rate and must be elected within one year of the date of the death of the member. Contact the Health Benefits Program, in writing, to obtain an application; NYC Health Benefits Section, 40 Rector St., 3rd Floor, New York, NY 10006.

- Under the law, you have a grace period of 45 days from the date you applied for COBRA coverage to pay the premium

- If applicable, you will receive a partial bill for the portion of the month beginning with the date of the qualifying event to bring your billing date to the first of the month

- Subsequent bills will be charged from the first day of the month during your COBRA continuation period

- Payment shall be on a monthly basis

- There is a 30-day grace period for subsequent late payments

- The premiums charged reflect 102% of the current rate (rates are subject to change; check with the plan to determine the premium at the time of your COBRA enrollment)

- The City will not “carve out” benefits provided through your Welfare Fund that are similar to those available in your plan’s Optional Rider. If you decide to purchase the Optional Rider, you must pay for the entire Optional Rider offered by your chosen plan

Active Non-Medicare Members

If you are a non-Medicare-eligible employee covered by the City program, you have the right, in certain situations, to continue benefits if you lose your coverage due to:

- Termination of your employment (for reasons other than gross misconduct on your part)

- Unpaid leave of absence

Retirees

You and your dependents are eligible to receive City-paid health care coverage if you have, at the time of retirement:

- 10 years of credited service as a member of a retirement or pension system maintained by the City (if you were an employee of the City on or before December 27, 2001, then at the time of your retirement you must have at least five years of credited service as a member of a retirement or pension system maintained by the City). This requirement does not apply if you retire because of accidental disability; and

- You receive a pension check from a retirement system maintained by the City

Spouse/Domestic Partners

If you are the non-Medicare-eligible spouse/domestic partner of an eligible employee or a retiree, you have the right to continue coverage under any of the available NYC health benefits plans if your benefits are reduced or terminated for any of the following reasons:

- The death of your spouse/domestic partner

- The termination of your spouse/domestic partner’s employment (for reasons other than gross misconduct)

- Divorce or legal separation from your spouse

Dependents

In the case of an eligible dependent child of an employee or retiree (including a newborn child who was born to the covered beneficiary or an adopted child who is placed for adoption with the covered beneficiary during a period of COBRA continuation coverage) he or she has the right to continue coverage under any of the available NYC health benefits plans and the SOC Fund if coverage is reduced or terminated for any of the following reasons:

- The death of the covered parent

- The termination of the covered parent’s employment (for reasons other than gross misconduct)

- The dependent ceases to be a “dependent child” under the terms of the Employee Benefits Program

Medicare-Eligible

Employees, retirees, spouses/domestic partners and dependents who are eligible for Medicare may be eligible to receive continued coverage, similar to COBRA, under the City’s Medicare-Supplemental plans. Periods of eligibility shall date from the original qualifying event up to 18 months in the case of loss of coverage because of termination of employment.

HOW TO APPLY FOR COBRA

Active & Retired Members

If you qualify for COBRA, you may continue coverage by using the COBRA Continuation of Coverage application form. However, if you are the spouse of a deceased member see note under Benefit Overview entitled “Special Continuation of Coverage.”

You can review COBRA information, download registration form(s), view current premium rates, and get the addresses of health care carriers on line by visiting the NYC Office of Labor Relations web site at www.nyc.gov/olr (click on the “Health Benefits Program” icon).

NOTE: If you decide to purchase any of the Superior Officers Council (SOC) Health and Welfare Fund benefits, you can contact the SOC Fund to determine what benefits are available, and the associated costs. See SOC HEALTH & WELFARE CONTINUATION OF COVERAGE for further information regarding your union benefits.

SPECIAL INSTRUCTIONS FOR MEDICARE ELIGIBLES

Medicare eligible members should:

- Indicate their Medicare claim number and effective dates where indicated on the form for Medicare-eligible family members

- If you and/or your dependent(s) are about to become eligible for Medicare, and are already enrolled in coverage under COBRA, inform your carrier at least 30 days prior to the date you and/or your dependent(s) will become Medicare eligible

- A COBRA enrolled dependent(s) of the person who becomes Medicare eligible will be able to continue their COBRA coverage, whether or not the Medicare-eligible person enrolls in the Medicare-Supplemental coverage

- The COBRA continuation period for dependents will be unaffected by the decision of the Medicare-eligible employee or retiree

NOTE: You should contact your carrier for information about other Medicare-Supplemental plans that are offered; some plans may be better suited to your needs and/or less costly than the plan that is provided under the City’s contract.

The SOC Fund provides continuation of coverage based on the same criteria spelled out in the Consolidated Omnibus Budget Reconciliation Act. Under the Fund, qualified beneficiaries who elect Continuation of Coverage pay for this coverage (exceptions may apply – see Surviving Spouse/Dependent(s) SOC Health and Welfare Fund Benefit). You or your dependents may be required to pay the necessary premium for the following benefits:

- Prescription Drug Benefit

- Dental Benefit

- Optical Benefit

Employee

If you are an employee, you will become a qualified beneficiary if you lose your coverage under the Fund if any one of the following qualifying events happens:

- Your employment ends for any reason other than your gross misconduct

Spouse/Domestic Partner

If you are the spouse/domestic partner of an employee, you will become a qualified beneficiary if you lose your coverage under the Fund due to any of the following qualifying events:

- Your spouse dies

- Your spouse’s employment ends for any reason other than his or her gross misconduct

- You become divorced or legally separated from your spouse, if married

Dependent Children

Your dependent children will become qualified beneficiaries if they lose their coverage under the Fund due to any of the following qualifying events:

- The parent employee dies

- The parent employee’s employment ends for any reason other than his or her gross misconduct

- The parents become divorced or legally separated

- The child stops being eligible for coverage under the Fund as a “dependent child” and is not eligible for coverage under any other plan

The SOC Fund will offer Continuation of Coverage to qualified beneficiaries only after the Fund Administrator has been notified that a qualifying event has occurred. When the qualifying event is the end of employment or death of employee, the employer must notify the Fund Administrator of the qualifying event within 30 days.

For the other qualifying events (divorce or legal separation of the employee and spouse or a dependent child’s losing eligibility for coverage as a dependent child), YOU must notify the Fund Administrator. The Fund requires you to notify the Fund Administrator within 60 days after the qualifying event occurs. In the event of death, a copy of the death certificate must be provided. In the event of divorce, you must send a copy of the divorce judgment. In the event of legal separation, you must send a copy of the Court Order of Separation.

Once the Fund Administrator receives notice that a qualifying event has occurred, SOC Health & Welfare Fund Continuation of Coverage will be offered to each of the qualified beneficiaries. For each qualified beneficiary who elects the SOC Health & Welfare Fund Continuation of Coverage, such coverage will begin on the date of the qualifying event or the date that Fund coverage would otherwise have been lost, if later.

SOC Health & Welfare Fund Continuation of Coverage is in most circumstances a temporary continuation of coverage (exceptions may apply – see Surviving Spouse/Domestic Partner/ Dependent(s) SOC Health and Welfare Fund Benefit).

- When the qualifying event is the death of the employee, divorce or legal separation, or a child losing eligibility as a dependent child, continues for a maximum of up to 36 months.

- When the qualifying event is the end of employment, based on termination not related to gross misconduct, Continuation of Coverage lasts for up to 18 months.

EXTENDING COVERAGE

There are two ways in which the 18-month period of SOC Health & Welfare Fund Continuation of Coverage can be extended:

Disability Extension of 18-Month Period of Continuation Coverage

If you or anyone in your family covered under the Fund is determined by the Social Security Administration to be disabled at any time during the first 60 days of Continuation of Coverage, and you notify the Fund Administrator in a timely fashion, you and your entire family can receive up to an additional 11 months of Continuation of Coverage, for a total maximum of 29 months. You must make sure that the Fund Administrator is notified of the Social Security Administrator’s determination by sending a copy of the determination letter within 60 days of the date of determination and before the end of the 18-month period of Continuation of Coverage. This notice should be sent to the Fund Administrator.

Second Qualifying Event Extension of 18-month Period Continuation Coverage

If your family experiences another qualifying event while receiving Continuation of Coverage, the spouse and dependent children in your family can get additional 18 months of coverage, up to a maximum of 36 months. This extension is available to the spouse and dependent children if the former employee dies or gets divorced or legally separated while on Continuation of Coverage. The extension is also available to a dependent child when that child stops being eligible under the Fund as a dependent child while on COBRA. In all of these cases, you must make sure that the Fund Administrator is notified of the second qualifying event within 60 days of the second qualifying event. This notice must be sent to the Fund Administrator. In the event of death, a copy of the death certificate must be provided. In the event of divorce, you must send a copy of the divorce judgment. In the event of legal separation, you must send a copy of the Court Order of Separation.

A federal law, the Health Insurance Portability and Accountability Act (HIPAA), requires the Superior Officers Council Health and Welfare Fund (“the Fund”) to protect the confidentiality of your private health information. A complete description of your rights under HIPAA can be found in the SOC Fund’s privacy notice, which was distributed to all current members of the SOC Fund prior to April 14, 2003 and is distributed to all new members upon enrollment, a copy of which is available from the SOC Fund Office

The SOC Fund will not use or further disclose information that is protected by HIPAA (“protected health information”), except as necessary for treatment, payment, operations of the Fund, or as permitted or required by law. By law, the SOC Fund has required all business associates to also observe the Fund’s privacy rules. In particular, the SOC Fund will not, without authorization, use or disclose protected health information for employment-related actions and decisions.

The Board of Trustees may change the benefits provided by this SOC Fund. The Board of Trustees adopts rules and regulations for the payment of benefits and all provisions of this handbook are subject to such rules and regulations and to the Trust Agreement, which established and governs the Fund operations.

All rules are uniformly applied by the SOC Fund Office. The action of the SOC Fund Office is subject only to review by the Board of Trustees. A member or beneficiary may request a review of action by submitting notice in writing to the Board of Trustees at the following address:

Superior Officers Council

40 Peck Slip

New York, NY 10038

The Trustees shall act on the appeal within a reasonable period of time and render their decision in writing, which shall be final and conclusive and binding on all persons.

The SOC Fund has the right to recoup overpayments that were caused by an error in the processing of a claim, or if additional information comes to the attention of the Fund after the claim has been paid. Furthermore, the SOC Fund has the right to suspend one or more benefits if you have received overpayments or have in any way abused the SOC Fund’s benefit program.

If the SOC Fund finds it has overpaid you, or an otherwise ineligible dependent, for a particular benefit, it has the right to recoup the excess amount from you, the member. The SOC Fund may bill you for overpayments made, and/or, it may also reduce future benefit payments to offset the overpaid amounts or it may suspend your benefits until the overpayment is recouped.

Medicare is health insurance for the following:

• People 65 or older

• People under 65 with certain disabilities

• People of any age with End-Stage Renal Disease (ESRD) (permanent kidney failure requiring dialysis or a kidney transplant)

DIFFERENT PARTS OF MEDICARE

The different parts of Medicare help cover specific services:

Medicare Part A (Hospital Insurance)

• Helps cover inpatient care in hospitals

• Helps cover skilled nursing facility, hospice, and home health care

Medicare Part B (Medical Insurance)

• Helps cover doctors’ services, hospital outpatient care, and home health care

• Helps cover some preventive services to help maintain your health and to keep certain illnesses from getting worse

Medicare Part D (Medicare Prescription Drug Coverage)

• A prescription drug option run by Medicare-approved private insurance companies

• Helps cover the cost of prescription drugs

• May help lower your prescription drug costs and help protect against higher costs in the future

NOTE: In most cases we do not recommend members subscribe to a Medicare Part D Prescription Plan. The SOC Prescription Plan will under most circumstances provide you and your family with sufficient prescription drug coverage. However, there may be occasions where the prescription benefits offered by Medicare Part D are more cost efficient than those offered by the SOC. If you need further assistance, contact the SOC Fund Office at (212) 964-7500, option 1.

COST OF MEDICARE

Medicare Part A

You don’t pay a monthly premium for Medicare Part A coverage. The taxes you paid to Medicare while working will cover the cost of your Medicare Part A coverage.

Medicare Part B

You pay the Part B premium each month. Most people signing up for Medicare Part B will pay the standard amount of $170.10 for 2022. However, if your modified adjusted gross income as reported on your IRS tax return from two years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount, you may pay more.

Each year Social Security will notify you if you must pay more than the standard premium. Whether you pay the standard premium or a higher premium can change each year depending on your income. For more information regarding Medicare premium rates visit www.medicare.gov.

The Medicare monthly premium is deducted from your Social Security check. If you are not currently receiving a Social Security Check, Medicare will send you a bill for your Part B premiums every three months.

If you don’t sign up for Part B when you’re first eligible, you may have to pay a late penalty for as long as you have Medicare. Your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didn’t sign up for it.

Medicare Part D

For information regarding Medicare Part D premiums, visit www.medicare.gov.

HOW TO ENROLL IN MEDICARE

Medicare has different guidelines for eligibility. It is important that you know when and how to enroll in Medicare.

If you already get benefits from the Social Security Administration you will automatically be entitled to Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) starting the first day of the month that you turn 65. You do not need to do anything to enroll. You will receive a Medicare card approximately 3 months before your 65th birthday.

If you are not receiving Social Security you can enroll in Medicare up to three months before your 65th birthday and no later than three months after the month of your birthday. This is called the initial enrollment period. You will need to submit an application to the Social Security Administration. You can also sign up for Part B at your local Social Security office. They will determine your eligibility and send you a Medicare card.

If you wait until you are 65, or sign up during the last three months of your initial enrollment period, your Medicare Part B start date will be delayed.

If you are under age 65 and disabled, and have been entitled to disability benefits under Social Security for 24 months, you will be automatically entitled to Medicare Part A and Part B beginning the 25th month of disability benefit entitlement. You do not need to do anything to enroll in Medicare. Your Medicare card will be mailed to you approximately three months before your Medicare entitlement date.

For more information, visit www.medicare.gov or call 1(800)MeDiCare (1(800) 633-4227), 24 hours a day, seven days a week for assistance.

GETTING YOUR AFFAIRS IN ORDER

The Trustees of the Superior Officers Council hope the information contained in the following pages will serve as a useful tool to you and your family to help prepare for the inevitable.

THINGS TO CONSIDER

You should give consideration to making pre-death arrangements. This should be discussed by couples and by parents with their families. You should also give consideration to having a “Family Durable Power of Attorney” (someone to take over your finances if you become incapacitated or incompetent). Following are two checklists, one for the member to use as a guide in order to have your affairs in order beforehand, and one for your family to help guide them through some of the things that will need to be done after your death.

Get organized now. One of the most daunting problems for beneficiaries is locating the things necessary to settle the estate. Make sure you know where to find important documents and information. Gather and keep the following items (if applicable) in a safe place:

- Will

- Living Will

- Trusts

- Deed(s)

- Location of and keys to safe deposit box(es)

- Life insurance policies

- Funeral and burial instructions

- Names and addresses of creditors/debtors

- List of assets

- List of all advisers (attorneys, accountants, insurance agents, stockbrokers, etc.)

Among the many things family members need to do is make timely notifications to Police Department units, respective unions and other governmental agencies. This is especially important since it will provide your family with information regarding the privileges they and you are entitled to. They should contact:

- NYPD Operations Unit

One Police Plaza

New York, NY 10038

646.610.5580

(Pallbearers are available in all five boroughs, all of Long Island and upstate New York, not beyond Dutchess County). - NYC Health Benefits Section

212.513.0470

(Request “COBRA for Life” application) - Captains Endowment Association

212.791.8292

(Regarding possible death benefit/life insurance) - Social Security Administration

800.772.1213 - Veterans Administration (if applicable)

800.827.1000 or visit the website at www.va.gov

(You may be entitled to a burial and/or plot-interment allowance, a VA National Cemetery Burial, headstone or marker, a Presidential Memorial Certificate, and burial flag.)

- NYC Police Pension Fund

233 Broadway, 25th Floor

New York, NY 10279

Attn: Retiree Death Benefits Unit

212.693.5607/5919

(In writing or by telephone) - Superior Officers Council

40 Peck Slip

New York, NY 10038

212.964.7500, option 1

(Regarding possible death benefit) - Lieutenants Benevolent Association

212.964.7500, option 2

(Regarding possible death benefit/life insurance)

Death Certificates (when applicable) for:

• Police Pension Fund

• Veterans Administration

• Motor Vehicle Bureau

• Probate Court

• State Department of Revenue (to obtain Non-Tax Certificate if real property is involved).

• Bank accounts held in trust for another (one for each if property held in a trust).

• Personal records

Note: The Funeral Director will usually obtain certificates as part of their service cost.

Marriage Certificates with Official Raised Seal for:

• Social Security Administration (not necessary if surviving spouse is already receiving benefits)

• Veterans Administration (if applicable)

Letters of Testamentary or Letters of Administration (if applicable) for:

• Motor Vehicle Bureau

• Bank accounts, brokerage house accounts, share of stocks or bonds, etc. (if in the decedent’s name only).

Armed Services Discharge Papers —DD 214 (if applicable):

• The original papers are needed for Social Security, if spouse is not already receiving benefits (Service time counts toward qualification).

Copies of Paid Funeral Bill for:

• Police Pension Fund

• Probate Court

• IRS (if taxable estate)

Close/Transfer any Policies and/or Accounts (if applicable):

• Cancel the lease (after removing possessions)

• Notify life insurance carriers (request Form 712, “Life Insurance Statement” to be filed

with estate tax return)

• Notify vehicle insurance (continue policy until vehicle(s) is sold or transferred)

• Cancel homeowners insurance (continue policy until possessions are removed)

• Cancel credit cards and/or close charge accounts

• Transfer frequent flier miles (if applicable, in accordance with the will)

Note: In the case of couples, usually most of the property is held in joint names and the survivor obtains it “by operation of law.” However, there may be some items that were held in the name of the deceased only. In that case, it would be necessary to go to Probate Court to transfer ownership of that property, unless it is listed in trust.

INFORMATION FOR THE FAMILY

On the following pages is information for family members in the event of a member’s death. There are several ways in which the New York City Police Department characterizes the death of a member: members who are killed in the Line of Duty (active); members who die while in service (non Line-of-Duty – less than 20 years of service); members who die while in service (non Line-of-Duty – 20 years of more of service); and retired members

TO THE FAMILY OF A MEMBER KILLED IN THE LINE OF DUTY

The officers and staff of the Superior Officers Council recognize the loss of a loved one is always a traumatic event. However, they also realize this is even more traumatic when it is as the result of police action. For this reason, respective of the deceased member’s rank, either the President of the Captains Endowment Association or the Lieutenants Benevolent Association will be in contact with the family to offer continual guidance and support.

HEALTH BENEFITS

In recognition of the sacrifice made by the officer and the tremendous impact and burden placed on their family, the City of New York and the SOC Health and Welfare Fund will continue to provide health coverage and Fund benefits to the spouse/domestic partner and eligible dependent(s) at no cost. A representative from the member’s respective union will be available to provide you with any assistance that may be needed to continue your health benefits without interruption.

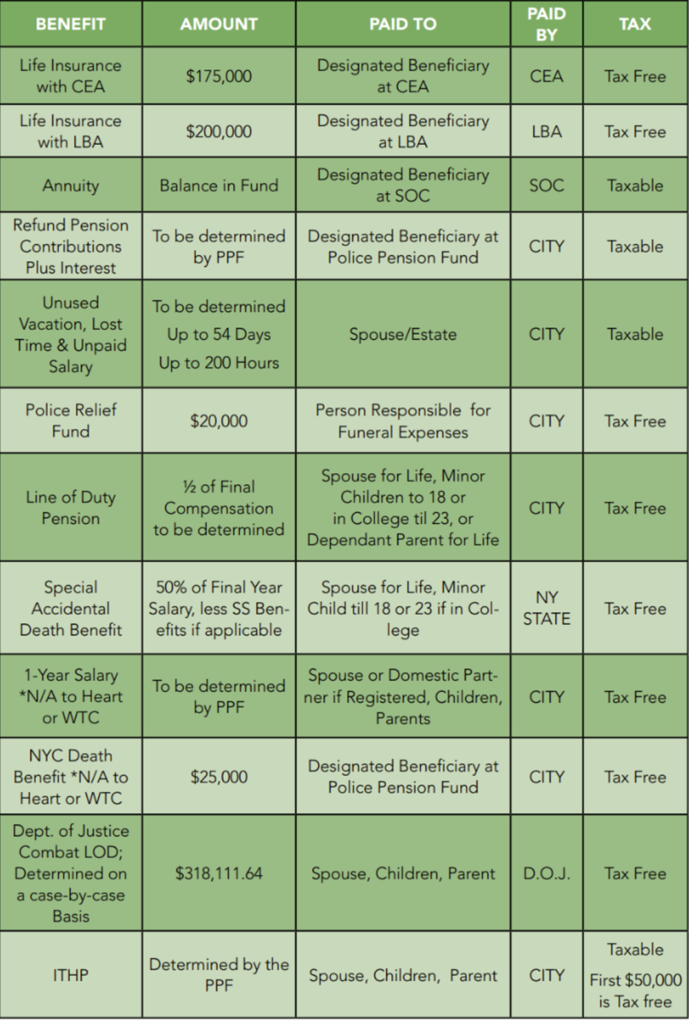

MONETARY COMPENSATION

The following chart reflects the monetary compensation a named beneficiary(s) may receive when a member of the Captains Endowment Association or Lieutenants Benevolent Association dies in the Line-of-Duty. This chart is provided as a guide. However, due to the fluidity of benefits, the Police Pension Fund should be contacted to verify the most up-to-date compensation amount.

CAPTAIN/LIEUTENANT

PENSION TIER II

ACTIVE MEMBER - LINE-OF-DUTY

Active Member – Less than 20 years Service

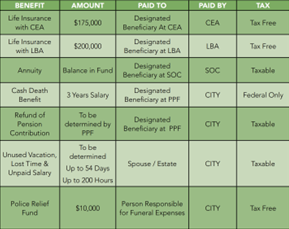

MONETARY COMPENSATION

The following chart reflects the monetary compensation a named beneficiary(s) may receive

when a member of the Captains Endowment Association or Lieutenants Benevolent Association dies as an Active Member in a non-Line-of-Duty situation with less than 20 years of service. This chart is provided as a guide. However, due to the fluidity of benefits, the Police Pension Fund should be contacted to verify the most up-to-date compensation amount.

CAPTAIN/LIEUTENANT

PENSION TIER II

ACTIVE MEMBER – NON-LOD DEATH (LESS THAN 20 YEARS)

Active Member -20 years or more of Service

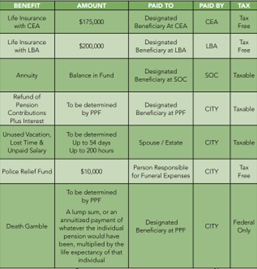

MONETARY COMPENSATION

The following chart reflects the monetary compensation a named beneficiary(s) may receive when a member of the Captains Endowment Association or Lieutenants Benevolent Association dies as an Active Member in a non-Line-of-Duty situation with 20 years or more of service.

This chart is provided as a guide. However, due to the fluidity of benefits, the Police Pension Fund should be contacted to verify the most up-to-date compensation amount.

CAPTAIN/LIEUTENANT

PENSION TIER II

ACTIVE MEMBER - NON-LOD DEATH (20 YEARS OR MORE OF SERVICE)

HEALTH BENEFITS

The spouse/domestic partner and eligible dependent’s health benefits, both major medical (GHI, HIP, etc.) and those benefits provided by the SOC Health and Welfare Fund, are terminated when a member dies. However, the spouse/domestic partner may apply for COBRA (Continuation of Benefits) coverage through the City of New York Office of Labor Relations, Health Benefits Section and the SOC Health and Welfare Fund Office for a continuation of the union benefits. See Section IV of this handbook for information provided under the “COBRA: Consolidated Omnibus Budget Reconciliation Act” and the SOC’s Continuation of Coverage.

Note: Those retirees who received an Accident Disability Pension, i.e. Heart Bill, should be aware that if the cause of their death was directly attributed to the condition on which they received the Accident Disability, their surviving spouse/domestic partner may be eligible to continue receiving the deceased member’s Major Medical and SOC benefits at no cost.

BENEFITS OVERVIEW

The Superior Officers Council provides two “Death Benefits” to its members. Members are entitled to one benefit based on when the member retired, and/or what option the “Retired” member selected.

DEFINITIONS:

Surviving Spouse/Domestic Partner/Dependent(s)

SOC Health and Welfare Fund Benefit

This benefit is provided to the deceased retired member’s qualified dependents (defined below) and includes prescription, optical and dental coverage. This coverage does not include Major Medical Coverage, i.e. GHI, HIP, etc. The coverage is provided for three years at no cost to the surviving spouse/dependent(s) and gives the eligible beneficiaries the added option of continuing the benefits indefinitely for a premium.

$5,000 Death Benefit

The SOC Fund provides a $5,000 death benefit. This benefit is payable to the designated beneficiary(s) upon approval of the claim by the Trustees. The member’s beneficiary(s) will be forwarded a death claim form that must be completed by the beneficiary(s) and notarized. The claim form must be submitted with an official death certificate to the SOC Fund Office for processing.

ELIGIBILITY:

Retired (as of 1/1/2010)

The eligible beneficiaries of members who retired on or after January 1, 2010 are entitled to the surviving spouse/Domestic partner/Dependent(s) SOC health and Welfare Fund benefit.

Retired (1/1/1971 to 12/31/2009)

If you retired between January 1, 1971 and December 31, 2009, you were offered the choice to convert the $5,000 Death benefit during a one-time enrollment period to the surviving spouse/Domestic partner/Dependent(s) SOC health and Welfare Fund benefit.

Beneficiary(s) Eligible for the Surviving Spouse/Domestic Partner/Dependent(s) SOC

Health and Welfare Fund Benefit

Spouse, or registered domestic partner and eligible dependent children. Eligible children include natural children, legally adopted, stepchildren (rules apply) and children for whom you have court-appointed guardianship or legal custody and who live with you permanently. For the purpose of the Dental and Optical Benefit, eligible dependent children are covered to the last day of the month of their 23 birthday. For the Prescription Plan, dependent children who were previously enrolled in the Optional Prescription Drug Rider will be covered until December 31st of the year they reach the age 23 years.

Beneficiary(s) eligible for the $5,000 Death benefit

The death benefit payment will be made to your designated beneficiary. However, if you have not designated a beneficiary, the death benefit will be paid to the following successive preference beneficiary:

1. Spouse

2. Children (equal shares)

3. Parents (equal shares)

4. Brothers and sisters (equal shares)

5. The estate of the deceased

If a member wishes to change the beneficiary designation for the $5,000 Death Benefit, he/

she can contact the SOC Fund Office and request a Change of Beneficiary Form.

Note: Those retirees who received an Accident Disability Pension, i.e. Heart Bill, should be aware that if the cause of their death was directly attributed to the condition on which they received the Accident Disability, their surviving spouse may be eligible to continue receiving the deceased member’s Major Medical and SOC benefits at no cost.